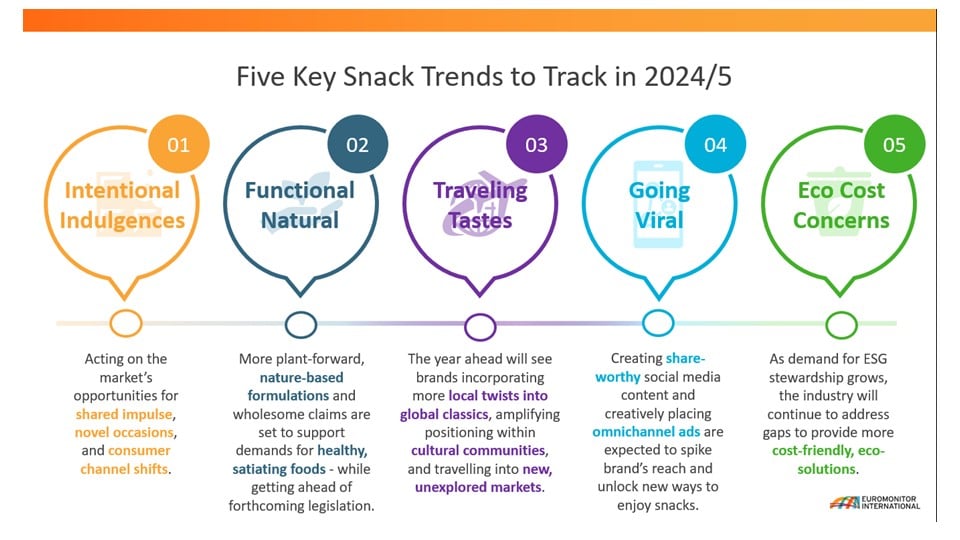

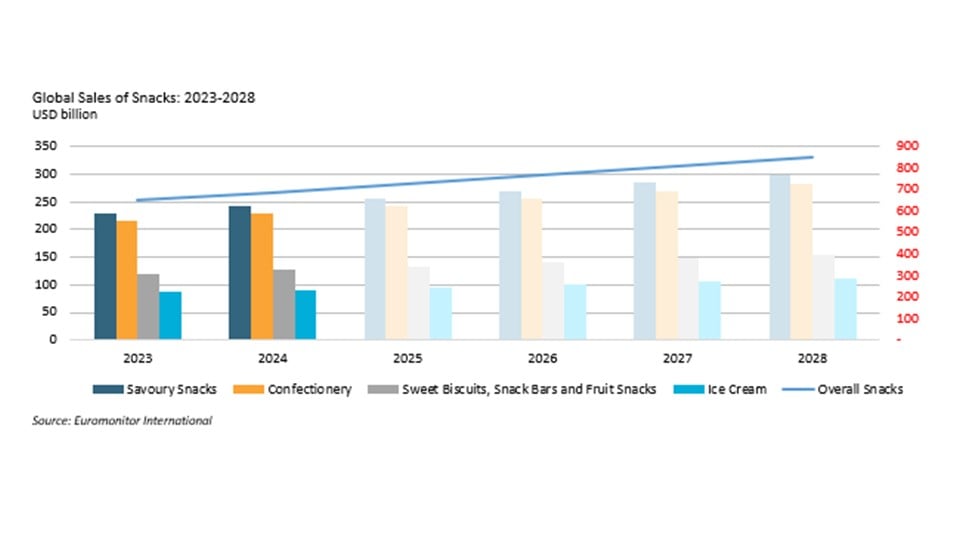

Global snack sales continue to grow – set to surpass USD680 billion in retail sales in 2024, up 5.6% from 2023. Though inflation is slowing and promotions are peaking, challenges such as the cocoa crisis and consumers’ reassessment of their snack spend persist. Euromonitor International’s snacks research has identified five key trends set to shape snacks in the year ahead.

Intentional indulgences

Though the desire to indulge in snacks remains strong, the food affordability crisis has led to dissatisfied cravings. Among the many mitigation strategies being adopted, consumers say they aren’t snacking as often and are being more selective in what they buy.

A spike in impulse and shared impulse (51-100g) sales has been witnessed as consumers benefit from lower price points, yet slightly larger quantities. Holiday, special occasion, and gathering consumption is fuelling growth (eg Christmas, non-romantic gift-giving, graduations). Additionally, channel strategy refinements, due to the channel conscious shopper shifts trend, improving physical and e-impulse sales, are another important consideration. Manufacturers should continue to explore opportunities in shared impulse, expanding occasions, and channel shift behaviours to retain snacks’ performance.

Promoting functional natural

Products with natural and plant-based claims are expected to grow in the market and in consumer favour. Euromonitor’s Voice of the Consumer: Health and Nutrition Survey, fielded February 2024, found 15% of global consumers believe clean label is an important feature in foods; however, attributes like organic, all natural, and free of preservatives are even more important and tie into consumers’ perception of “natural”. Snacks integrating whole fruit, vegetable, grain, and seed ingredients have grown and manufacturers in both the sweet and savoury domains have been establishing plant-based lines to position brands closer to nature and health.

Additionally, legislative pushes are pushing the trend (eg the US’s string of state artificial colourant bans like red no 3 and 40). These bans will impact popular products like flavoured tortilla chips, puffed snacks, boiled sweets, gummies, and chews where they’re commonly found. Similar bans are already established in the EU, Japan, and other parts of the world.

Ingredient innovation in the more than 26,000-tonne global market for natural colours in snacks is set to expand

Source: Euromonitor International

Promoting plant-forward and natural ingredient formulations alongside wholesome claims will support consumers’ hunt for wellness, satiety, and earth stewardship while allowing the industry to comply with forthcoming demands.

Travelling tastes

Cultural relevance remains a significant trend within global and local snacking. The movement of people across the globe is spawning increasingly diverse generational cohorts and leading to the movement of cultural eating patterns, flavours, and the sharing of these.

Heat levels in food, for example, has been a rising trend for a while – catalysed by Latin cuisines and transformed by Asian and African tastes.

Spicy flavours have become so popular that they made up nearly 15% of tracked new salty snack product launches in 2023

Source: Euromonitor International

Another example of cultures’ influence on snacking is seen in the affinity for polarising textures – pronounced in Asia – giving rise to new, contrasting combinations around the world like chewy and crunchy or liquid and solid.

The year ahead will see brands incorporating more local twists into global classics, amplifying positioning within cultural communities, and travelling into new, unexplored markets.

Going viral

The digital world’s influence is maintaining a stronghold over consumers and their snacking habits. Not only do consumers frequently snack while engaged in digital activities, but digital platforms are also becoming a greater source of inspiration and information for product purchases. Consumers’ ability to engage with brands taps into the Experience More megatrend. Euromonitor’s E-commerce tracked an uptick in Q1 2024 online snack sales across the globe. Manufacturers like Ferrero and Mars are seeing online sales growth in markets such as Brazil and the US with strong digital advertising and promotions.

In the year ahead, viral social media trends and creatively placed online ads are expected to enhance brands’ reach and unlock new occasions and ways to enjoy snacks. However, brands must be sure to navigate increasing regulations to ensure compliance.

Eco cost concerns

The industry is addressing the costs of producing environmentally, socially, and governmentally (ESG) friendly snacks more collaboratively. Growing concern over climate change, community welfare, and food safety has resulted in higher demand for responsibly produced snacks. Consumers are more interested in companies that produce sustainably, support local communities, and are charitable.

“Green” snacks (eg Rainforest Alliance certified), recyclable, or with natural claims, remain at less than 5% of the market, but saw value CAGRs above 6% between 2020 and 2023

Source: Euromonitor International

As the year progresses, the industry will continue to develop conversations on how to deliver more impactful, cost-friendly transformations that meet demand for ESG stewardship.

Keep pace with this year’s trends

As snacking develops, Euromonitor’s five key trends in snacks offer paths for strategy and growth development.

For more information on the state of snacking and trends to watch out for in 2024-2025, please see Euromonitor International’s report, World Market for Snacks.