The global economic slowdown is a key downside risk for commodity markets in 2023. Slowing manufacturing activity amid softer consumer and B2B demand, as well as weaker capital investment due to high borrowing costs and lingering recession concerns, are expected to dent demand for energy and metal commodities. As consumers pull back on spending amid high inflation, food commodities will also suffer from weaker demand.

On the other hand, the anticipated rebound in demand from China following the end of its zero-COVID policy, softer-than-expected landing of Western economies and potential supply disruptions due to geopolitical tensions and extreme weather events could provide upward pressure for prices across all commodity groups over the year. In addition, as a weakening US dollar makes the US dollar-denominated commodities cheaper in non-dollar currencies, the expected depreciation of the US dollar from last year’s highs could boost commodity demand and prices in 2023.

Energy prices to ease in 2023, but multiple upward risks persist

Energy prices are set to average lower in 2023 compared to last year amid weaker global demand prospects and a healthy supply outlook. As per the International Energy Agency’s (IEA) estimates, healthy oil supply growth in the US, Canada, Brazil, Norway and Guyana is expected to offset the restrained output in Russia and other OPEC+ countries. There are, however, upside risks, including stronger-than-expected demand from China’s manufacturing sector, cuts in global supply and US dollar depreciation. In addition, extreme heatwaves could limit hydropower generation and boost electricity demand for cooling.

Natural gas prices in Europe saw the sharpest decrease in January 2023, as Europe has come out with higher-than-expected natural gas storage amid mild weather and strong liquified natural gas (LNG) imports. The drop in prices and strong stocks have mitigated the risk of energy shortages in the region over the near term. Nevertheless, in 2023, natural gas prices are projected to remain historically elevated, as European stock replenishing ahead of next winter without Russian gas supplies, along with reviving demand from China, will put upward pressure on LNG demand. Meanwhile, oil prices inched up in January 2023, driven by an improving demand outlook from China, which is expected to drive roughly half of global oil demand growth in 2023, according to the IEA.

Although energy prices eased from the 2022 peak, businesses continue to face elevated cost pressures and squeezed margins, especially across energy-intensive industries, such as chemicals, metals, cement and transportation. To mitigate the impact, companies are increasing investments in renewable energy and energy-efficient solutions, optimising energy consumption, turning to alternative fuels, stockpiling, price hedging and relocating to regions with lower energy costs. For example, British chemical multinational INEOS raised EUR3.5 billion for the construction of a highly energy-efficient ethane cracker facility in Belgium, which will be powered by low-carbon hydrogen.

Weaker consumer demand to limit agrifood price growth

Prices for agrifood commodities inched up in January 2023 thanks to rising grain prices. Prices for corn and soybeans strengthened as severe drought in South America intensified supply concerns, while rice prices rose on the back of greater demand. Intensification of the war in Ukraine is another upside risk for grain prices, as poorer harvest in Ukraine and disruptions to grain exports from the Black Sea region could fuel a price rally. In contrast, wheat prices declined in early 2023 on higher supply expectations from projected record harvests in Australia and India and recovering exports from Russia and Ukraine.

Despite supply fears and upward pressures stemming from China’s reviving consumption, prices for major agrifood commodities are expected to stay softer in 2023 relative to a year before, with lingering cost-of-living crisis and higher borrowing costs translating into weaker demand for food and feed from consumers and farmers. Moreover, weaker prices of fertilisers will increase the affordability of inputs for farmers, and higher use of fertilisers could help boost crop yields and supply. Softer agrifood commodity prices are set to ease cost pressures for food and foodservice businesses.

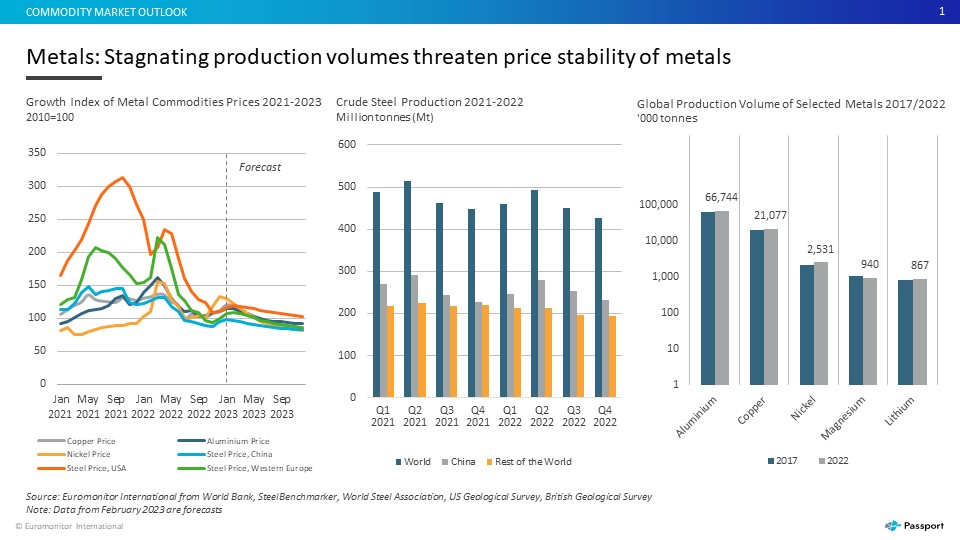

Prices of metals forecast to remain stable, but insufficient supply remains the key risk

Prices of the key basic metals are forecast to increase in Q1 2023. The reopening of China’s economy and better-than-anticipated industrial sector growth in Europe in large part support faster demand for growth metals. The depreciation of the US dollar also helps to stimulate the demand for industrial metals as it is cheaper for international buyers to purchase commodities.

Despite the price increase in Q1 2023, prices of metals still remain lower than in Q1 2022 as the global supplies recovered after the initial shock caused by Russia’s invasion of Ukraine. Prices of key metals are forecast to remain stable throughout 2023 as weaker global economic and investment growth as well as the slowdown in the construction sector are expected to outweigh positive effects on the global demand side for metals and cap the prices.

Insufficient production volumes of metals are the biggest risk factor for price stability in 2023. Despite the recovering demand, investments into new mining projects remain subdued and could cause supply problems. For example, one of the world’s largest copper miners, Freeport-McMoRan, noted that the mining industry does not have enough investment planned to avoid potential supply disruptions. US aluminium producer Alcoa also indicated that its inventory levels in 2023 will remain low and could be insufficient to meet the demand if economic growth in China accelerates.

Shortages of the non-ferrous metals would in large part hurt industries focusing on renewable energy and battery production. Sustained price pressures on steel and aluminium could also impact automotive, aerospace, machinery and construction sectors that, on average, spend 2-6% of total costs on the basic iron and steel and non-ferrous metals. Higher prices of metals would increase operating costs and are likely to pressure companies’ profit margins.

For further insight, please read Euromonitor International’s global reports on major commodities, here, and download your copy of our free report, Global Trends in the Commodities Market.