Households in Asia Pacific are experiencing major structural transformation. The growth of urban concentrated households is influencing consumption patterns, while lifestyle changes result in changing household composition from family-focused to solo-living dwellings. Reduced birth rates and the rapid increase of ageing populations also bring a new set of challenges that will impact economic growth.

Six out of 10 Asia Pacific households will be urban by 2040

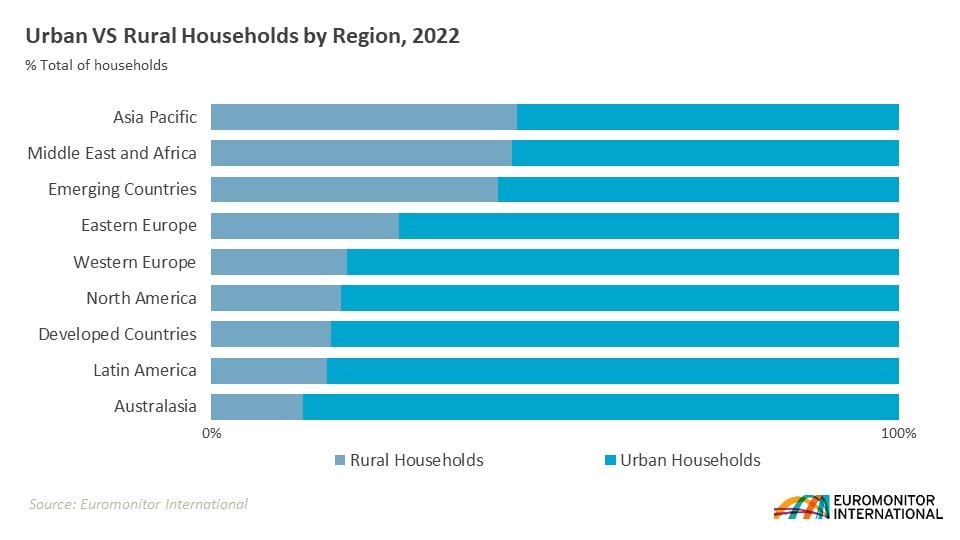

Asia Pacific is home to nearly two thirds of the world’s population, with over 2.2 billion citizens residing in major cities. By 2040, urban households will experience growth of 21%, resulting in six out of 10 homes being situated in urban areas. Only outpaced by the Middle East and Africa, Asia Pacific will see the second fastest rate of urbanisation globally.

Asia Pacific is home to nearly two thirds of the world’s population, with over 2.2 billion citizens residing in major cities

Urban expansion and development will result in increased demand for smaller dwellings, multifunctional appliances as well as various discretionary goods and services.

India experienced massive internal migration as millions of migrant workers moved back to their villages during the COVID-19 pandemic, maintaining the country’s label as the largest rural population with over 63% of households situated in rural areas. China, however, remains the largest urban market, adding over 150 million new urban households by 2040. Chinese cities are promising consumer markets, as they offer a large, growing pool of consumers with rising income levels and are supported by economic strength, innovation capabilities and high employment rates.

Single-person households continue to stand tall

Couples with children will remain the most significant household type throughout 2022-2040 in Asia Pacific, and all regions in the world. However, from 2022 to 2040, single-person households will have the strongest growth in Asia Pacific, growing by 78% compared to couple with children that will experience an increase of 26%.

Demand for family-orientated products that appeal to children, or for subscriptions focused on families, is less prominent in China, Japan and South Korea. Already in 2022, the average number of children per household was well below the regional average of 0.9 children per household, and will remain such until 2040. China will experience the most significant growth in single-person and couple without children households by 2040, followed by India for couple without children households and Japan for single-person households.

Single-person households in Asia will see the greatest increase as more young people leave home, marriage is delayed, and birth rates decline

Source: Euromonitor International

Apartment developments and product offerings aimed at individuals will continue to grow as companies and property developers cater to this segment.

The conundrum of ageing populations in Asia Pacific

In Asia Pacific, household heads aged 60+ will make up the largest proportion of household heads by 2040. Owing to increased life expectancy, increased urbanisation and resulting access to medical care, China and India will add the greatest number of senior citizens over the forecast period.

The ageing population remains a major challenge for countries, yet many governments have neglected its detrimental consequences. The major threat is to economic growth, as more retirees means lower incomes, fewer workers and increased pressure on healthcare and pension systems. Consumer expenditure and consumption will also be negatively impacted, as senior citizens are more cautious in their spending habits.

As governments struggle to find finances to support retirees, a few countries have tried implementing policies in response to the demographic shift. For example, China aims to raise the legal retirement age, while bringing migrant workers could be another solution; however, such solutions are more complicated in a country such as Japan, which is strict on immigration.

Top three strategies to cater to households in Asia Pacific:

- Consider the strong growth of urban households and their impact on consumption patterns;

- Understand the shift from couple with children to single-person household types;

- Be aware of the consequences of the ageing population and the possible threats and opportunities.

Learn more about changing households compositions in Asia Pacific in our report, Households in Asia Pacific, to understand how those three strategies can benefit your business in the future.